SaaS Metrics Drilldown: Key SaaS Goals

The Internet continues its evolution. Together with it, the software industry is suffering seismic shifts towards a service-oriented economic model. This model brings a more predictable revenue flow to the enterprises, but it also creates new challenges like the necessity to achieve global SaaS compliance to prosper. It is essential to understand which portion of your business data is of the most value at your particular business stage and which one can be put aside for later. Concentrating on the wrong metrics at the wrong time can be disastrous for a SaaS company. Continue reading for an answer.

Every Start-up’s dilemma

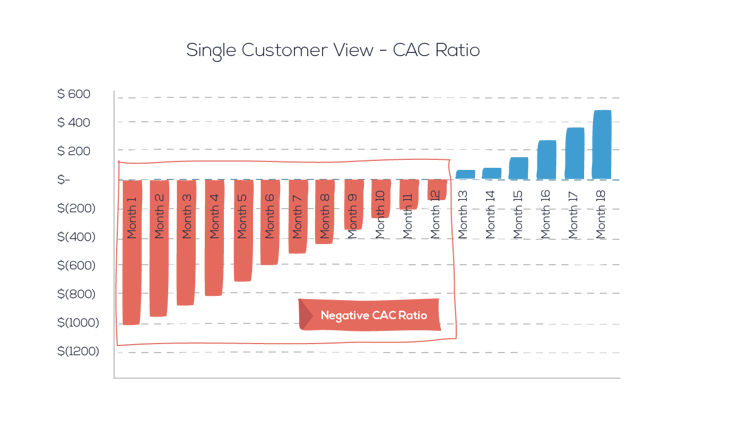

Getting confused about a SaaS company in the start-up phase is easy. As the foundation of a SaaS service is an ongoing relationship between the company and the customer, the fruits of it are not always visible at first. The start-ups rely on the future outcome of this relationship. The idea is simple; the initial customer acquisition costs (CAC) are painful, and the ROI is not visible instantly. It is recovered in small monthly installments over a long period. It might be some time before a SaaS start-up reaches a palpable profit. In other words, your profitability doesn’t entirely rely on your initial sale but many repeated sales to the same customer. Therefore, a longer relationship equals more revenue. It is very easy to get lost in this debit-credit limbo. But even in the start-up phase, it is vital to identify if you are on the right track or not, to take action when it is needed and where it is needed. This is why we are launching a series of articles which will provide comprehensive guidance that will help you efficiently measure your business performance, increase your profits, and minimize costs.

No 3rd party integrations. No hidden costs. No wasted time.

Just a solution as unique as your business’s needs.

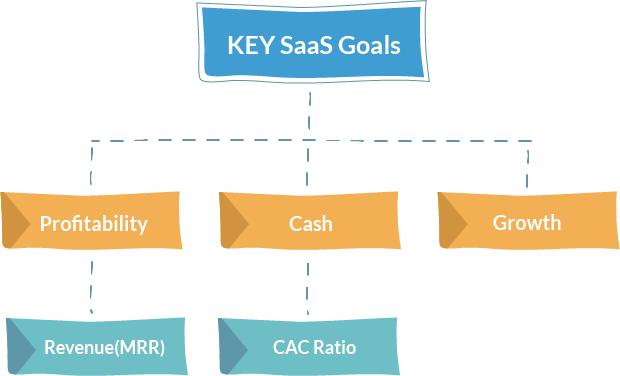

Today, we would like to tell you about the main goals and objectives all SaaS companies have in common, and in the next articles, we will analyze every one of them in detail.

- Profitability: this is, of course, the ultimate goal for any business.

- MRR (Monthly Recurring Revenue): This is one of the most important KPI’s out there and it needs to be watched at all times. It is usually the largest contributor to Profitability. It represents all of the monthly sales your customers bring to your company.

Monthly Recurring Revenue consists of:

- New Sales

- Renewals

- Upgrades

- Losses or Revenue Churn

- Cash Flow: this indicator is not met in every guide out there, nevertheless, it is very critical to keep an eye on it in SaaS business. It represents the cash flow every customer brings over a certain amount of time (let’s say a year). It is difficult to forecast it, as there may be quite a high upfront cash amount spent on your marketing efforts to acquire a customer, followed by costs to serve the customer. At the same time, the ROI comes in small recurring payments over a long period. This challenge can be overcome by using longer-term contracts with advance payments (although not applicable to every product).

The Cash Flow in SaaS Model is composed of the following elements:

- Cash from invoices from existing customers

- Cash from invoices from future renewals

- Cash from invoices for new contracts (new sales)

- CAC ratio: You can find many complex formulas to calculate the CAC ratio, but essentially this indicator represents the amount of time needed to recover CAC. It is critical for every SaaS company to precisely calculate the number of recurring payments needed from a customer to recover the cost of acquiring that customer. If we look at other service-oriented business models, such as banking and telecom services, we notice that they rely on the same KPIs as the SaaS model. The only difference is that for them, capital is cheap and abundant, and their service is sold more massively than SaaS. Therefore they can afford longer payback periods before recovering the initial acquisition cost (usually more than a year). A SaaS start-up is more time-pressed, as the capital on our planet is scarce and expensive, therefore, the majority of startups need to recover CAC in less than a year.

- Market share growth: We can see plenty of examples where companies that grab a larger chunk of the user base enjoy a series of positive reinforcements, as market leaders are usually on top of the list of consumers’ purchasing decisions, and the market leader enjoys more attention in the press, blogs, and social media. All these consequently drive more sales and referrals.

Essentially, the success of most SaaS startups relies on two general rules of thumb that incorporate all of the points above:

Please note that the two rules above are deducted from observing a large variety of startups, and they should serve as guidelines rather than hard and fast rules. It all depends on what customer pool you enjoy and how large your niche is. After the startup phase, these rules can be relaxed.

No 3rd party integrations. No hidden costs. No wasted time.

Just a solution as unique as your business’s needs.

So we have covered the most important goals of the SaaS model. In the next articles, we will analyze in detail every element that drives each of these targets. Stay tuned for more.

Meir Amzallag

Co-founder and CEO of PayPro Global

Ioana Grigorescu

Content Marketing Manager at PayPro Global

Meir Amzallag

Co-founder and CEO of PayPro Global

Ioana Grigorescu

Content Marketing Manager at PayPro Global

Hanna Barabakh

Hanna Barabakh is a Brand Ambassador at PayPro Global

Adina Cretu

Adina Cretu is a Content Marketing Manager at PayPro Global

Know first. Act fast.

It doesn’t take luck to make it, but it does take knowledge. Be the first to learn the latest industry insights and must know marketing tips and tricks. Sign up and enjoy! Always informed. Never Spammed.