Increase SaaS Conversion Rates in the Online Brazilian Market

Localizing payments is crucial when looking to increase SaaS conversion rates. We cannot stress how important this strategy is. Brazil’s payment landscape is a topic of interest for business owners, especially those in the SaaS industry. Discover how to navigate it, boost your sales conversions, and find a way to reach customers in Latin America’s largest market.

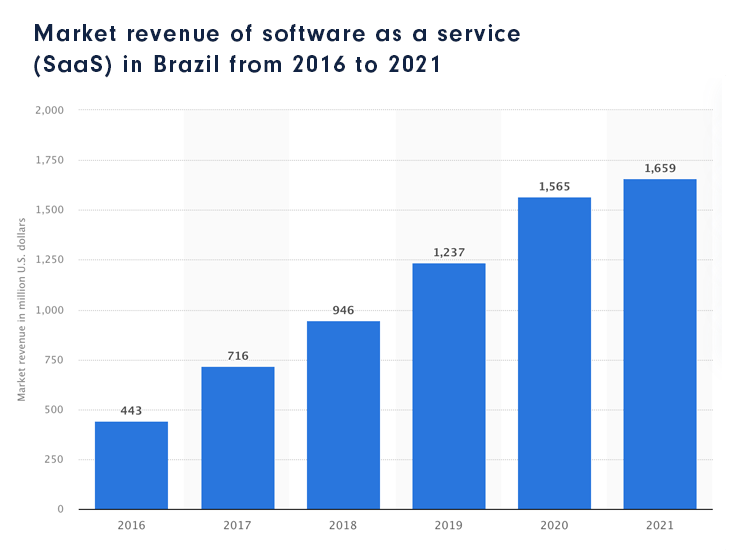

In 2022, the Brazilian SaaS industry was estimated at $3.9 billion. This means new and exciting business opportunities for software developers, especially due to the impressive growth speed and relatively low competition.

It’s true that Brazil remains one of those virgin markets where SaaS companies have actual chances to easily stand out.

No matter how good that all sounds, it’s crucial to mention that to succeed, you need more than a powerful product. You also require a robust payment infrastructure, allowing you to localize payments and capture them effectively.

This article explores the Brazilian payment landscape while pinpointing actual growth strategies companies looking to expand globally can implement.

Key Definitions and Background

Here are a few things to bear in mind:

SaaS Conversion Rate: The number of visitors or leads who complete action, whether it’s signing up for a trial or setting up a paid subscription.

Merchant of Record (MoR): A legal entity that sells goods or services to an end customer, taking full responsibility for collecting payments, handling global taxes and compliances, and offering customer support.

Brazilian Real (BRL): Brazil's official currency since 1994, operating as a floating currency with exchange rates.

PIX: Brazil's instant payment system was launched in 2020 by the Central Bank of Brazil.

Boleto Bancário: A popular Brazilian payment method.

Brazil SaaS Market Overview

Market Potential

When discussing possible customer bases, Brazil stands out with its population of 219 million people, making it the largest market in Latin America, as well as occupying the fifth largest country in the world. This certainly qualifies Brazil as a great opportunity for SaaS businesses, but it is also challenging to navigate various payment preferences and shopping behaviors.

Tailoring payment options to answer the demands of Brazilian customers can have a greater impact on this landscape than anywhere else. It can lead to impressive growth in sales conversion, significantly boosting business profitability.

Local Currency and Exchange Rates

Surviving different economic reforms since the introduction of the Brazilian Real (BRL) in 1994, Brazil is now regarded as a stable and strong economy, attracting investors from all over the world.

It’s relevant to note that the Brazilian Real functions as a floating currency. This means that the exchange rate is determined by the Forex market. This allows for economic growth. However, in this context, SaaS businesses must be aware of the "tourism exchange rate". Foreign companies can lose money if they are not careful.

Payment Methods

As mentioned, Brazil has a diverse payment method landscape, reflecting the preferences of its large population.

For instance, SaaS businesses that offered Bolleto or credit card installments as alternative payment methods noticed a 90% higher conversion rate.

In terms of payment methods, here is a short rundown of the top options in Brazil:

|

Payment Method |

Popularity |

|

Domestic-only Cards |

39% |

|

Pix |

233% |

|

International-enabled credit cards |

10% |

|

Bank slips (Boleto Bancário) |

9% |

|

Digital wallets |

8% |

|

Debit Cards |

1% |

|

Buy Now, Pay Later (BNPL) |

1% |

Localizing payments is crucial when looking to increase SaaS conversion rates. We cannot stress how important this strategy is.

Subscription Vs. One-Time Payments

Subscription are occupying a leading position in business models around the world, and Brazil makes no exception to this rule. In Brazil alone, subscription services generate R$ 1 million annually.

With 88% of consumers saying they’d commit to a recurring service, B2B and SaaS companies looking to expand in this region need to seriously consider this model in their pricing offering.

Brazilian Market: Key Takeaways

To enter and succeed within the Brazilian landscape, you need to consider the following aspects:

Here are a few things to bear in mind:

PIX is one of the country's most popular payment systems, continuously adding new features for recurring transactions.

Mastercard and Visa are among the preferred card payments.

The regulatory landscape remains cumbersome, making the launching of a business a time-consuming process.

Brazilian consumers are very concerned about security and data privacy; therefore, adherence to local regulations, like the LGPD (Lei Geral de Proteção de Dados), is crucial.

In 2022, the Brazilian SaaS market was worth $3.9 billion.

Artificial intelligence, machine learning, mobile-first strategies, and subscription-based pricing structures are some of the new trends in the online Brazilian market.

5 Strategies To Increase Conversion Rates In Brazil

So, your first goal is to sell in Brazil. Check. But you also need to make sure that you are selling a notable amount in order to recover your investment and increase business profitability.

So why not focus on achieving both goals from the very beginning?

Here are five best practices you need to consider when preparing for the road to success.

Localize your transactions

As we’ve mentioned earlier, Brazil stands out as a real growth opportunity due to its large customer base. But this is a double-edged sword because the greater your audience is, the more diversified their payment preferences are.

Offering diverse payment methods to cater to various preferences can have a tremendous impact on your sales conversion rates.

When entering the Brazilian market, be sure to provide potential customers with options like:

- Credit cards

- PIX

- Boleto Bancário

- Débito online

- Online bank transfers

- Mobile payments

Reduce your SaaS payment failures

Payment failures are a big issue for SaaS companies, and solving it will ultimately lead to increasing profitability. Make sure to partner with payment partners that offer:

- Robust cascading systems

- Smart payment routing

- Card validation

- Pre-dunning communications

- Multilingual customer support for dispute handling

A Merchant of Record solution like PayPro Global can provide you with a strong payment infrastructure to help you grow worldwide.

.webp?width=730&height=487&name=Key-Factors%20(1).webp)

Implemet language localization

Yes, investing time and resources into speaking the same payment language as your customer is a huge step forward. But you mustn’t stop here. Take another step and localize your website language as well.

60% of Brazilian consumers said they would purchase more if the brand in question would speak their language. And that’s saying something.

Present your SaaS products in your customer’s native language. This is a piece of advice you can apply to all countries you wish to expand in, not just Brazil.

Also, for this region in particular, your goal is to use Brazilian Portuguese and not literary Portuguese.

Be compliant with local rules and regulations

This is more of a requirement rather than a strategy. Complying with different regulatory laws is necessary should you wish to sell your products in Brazil or anywhere else, for that matter.

Yes, this process is time-consuming and must be treated seriously, It implies several administrative tasks, ongoing monitoring, and expert advice.

Failing to do so can lead to:

- Fines

- Penalties

- Business disruptions

- Potential legal consequences

Consider a hybrid revenue model

Although there is a growing market for subscription businesses in Brazil, adding one-time payment choices can provide extra income.

Your SaaS development can be further fueled by managing a hybrid business model that satisfies the needs of various customer segments, particularly when paired with:

- Adaptable pricing methods

- Free trials

- Regional costs

- Tailored advertising strategies according to cultural events

Is The Merchant of Record a Solution?

The straightforward answer is yes. The Merchant of Record model offers a comprehensive approach to worldwide expansion for SaaS and software business, simplifying operations and allowing developers to focus more on perfecting their products.

-1.webp?width=730&height=261&name=buyer-mor-seller-png-2%20(1)-1.webp)

Here is exactly how a trustworthy MOR can help your business expand in the online Brazilian market:

It manages complex tax and regulatory matters in Brazil.

Creating a local business entity is no longer needed.

It handles payment-related tasks including foreign exchange and invoicing.

Offering a large selection of local currencies and payment options, automated currency conversion, local billing, comprehensive tax processing, and dedicated customer service.

Your Dedicated eCommerce Partner.

Thrive with the industry’s most innovative all-in-one SaaS & Digital Goods solution. From high-performing payment and analytics tools to complete tax management, as well as subscription & billing handling, PayPro Global is ready to scale your SaaS.

Sell your SaaS globally with PayPro Global!

How Can PayPro Global Help?

PayPro Global has been in the payments market for over 15 years, becoming a reliable Merchant of Record for thousands of aspirational companies.Our vast expertise, experience, and innovative technology allow business owners to sell their software, digital products, and SaaS in various international markets, including Brazil.

PayPro Global succeeds in every market by:

- Using AI-powered cascade systems to achieve strong authorization rates.

- Offering various local currencies and payment methods and intelligent routing.

- Increasing international SaaS transactions and upholding PCI-DSS Level One accreditation, which guarantees the highest requirements for payment information security.

- Ensuring comprehensive tax administration.

Find out more about our all-in-one payment solution and how we can help strategically scale your SaaS business anywhere in the world, including the highly-rewarding Brazilian market.

Conclusion

Truly virgin markets are a thing of the past. However, Brazil remains among the few markets with a huge growth potential for SaaS and software business.

To ensure that your company will occupy a leading position in this region, invest in a strong partnership with a Merchant of Record that can effectively localize the entire payment process. This is the only way you can remain agile and strategic.

FAQs

Why should my SaaS company consider expanding to Brazil?

Brazil is a large, fast-growing, and relatively unsaturated SaaS market. With over 217 million people and a booming digital economy, it offers a significant customer base for strategic expansion, unlike more crowded North American or European markets.

What are the most popular payment methods in Brazil?

The most popular methods are domestic-only credit cards, Pix (instant payments), and Boleto Bancário. Offering these is critical, as international gateways often can't process them, and over 68% of shoppers may abandon their cart without these local options.

Can I sell in Brazil without setting up a local business entity?

Yes. By partnering with a Merchant of Record (MoR), you can sell in Brazil without a local entity. The MoR acts as your legal reseller, handling all local requirements. This drastically speeds up your time-to-market and helps you avoid major administrative and regulatory costs.

Ioana Grigorescu

Ioana Grigorescu is PayPro Global's Content Manager, focused on creating strategic writing pieces for SaaS, B2B, and technology companies. With a background that combines Languages and Translation Studies with Political Sciences, she's skilled in analyzing, creating, and communicating impactful content. She excels at developing content strategies, producing diverse marketing materials, and ensuring content effectiveness. Beyond her work, she enjoys exploring design with Figma.

-

1.Explore PayPro Global's Solutions: See how our platform can help you streamline your payment processing and boost revenue.

-

2.Get a Free Consultation: Discuss your specific needs with our experts and discover how we can tailor a solution for you.

-

3.Download our Free Resources: Access valuable guides, checklists, and templates to optimize your online sales.

-

4.Become a Partner: Expand your business by offering PayPro Global's solutions to your clients.

- Businesses should provide PIX with recurring transaction options.

- SaaS conversion rates can be considerably increased by localizing payment methods and presenting prices in BRL.

- By managing intricate duties like taxes and regulations, working with a reputable Merchant of Record like PayPro Global simplifies international expansion.

Get the latest news

![Global vs. Domestic Authorization Rates [Comparison]](https://blog.payproglobal.com/hs-fs/hubfs/header_Unlocking-Revenue-1.webp?width=350&height=250&name=header_Unlocking-Revenue-1.webp)