Video Games Tax: A Compliance Guide for Developers

Selling games online is exciting — you're building worlds, crafting stories, and connecting with players everywhere. But game development is also a business. Like any business, managing taxes is essential for staying compliant, avoiding penalties, and ensuring long-term growth.

In this guide, we break down the most important tax compliance challenges for game developers and explain how using a Merchant of Record (MoR) — like PayPro Global — simplifies the entire process.

Why Sales Tax Matters for Game Developers

Sales tax isn’t just a brick-and-mortar issue. It applies to digital goods too — including video games.

Key Facts:

In 2024, the global video games industry generated approximately $184.3 billion in revenue—primarily from digital software and microtransactions, with consoles being 84% digital.

Digital game sales reached 95.4% of total revenue, totaling around $175.8 billion. Mobile games alone contributed $92.5 billion, making them the only growing segment in 2024 (+2.8%), while console and PC segments fell 4% and 0.2%, respectively.

One report values the 2024 digital gaming market at $226.7 billion, with projections reaching $840.6 billion by 2033 (CAGR ~15.7% from 2025–33).

Another forecast pegs the entire global gaming market (including digital, hardware, etc.) at $298.1 billion in 2024, expected to grow to $505.2 billion by 2030 (CAGR ~8.7%).

Over 3.26 billion people worldwide now play video games, underscoring its massive global reach.

If you sell games online — whether through platforms, direct downloads, or subscriptions — you're likely responsible for charging, collecting, and remitting sales tax or VAT in multiple regions.

Common Video Games Tax Challenges

1. Sales Tax on Digital Goods

Not all jurisdictions define or tax digital goods the same way. For example:

California doesn’t tax most digital products.

New York taxes software downloads but not streaming services.

European countries apply Value Added Tax (VAT) on all digital game sales.

If you're selling video games globally, you're subject to an inconsistent patchwork of tax laws.

2. Defining the Source of a Sale

With physical products, tax is based on shipping address. But with video games:

Customers may use VPNs or purchase while traveling.

Payments made with virtual currency often lack clear location data.

Determining the customer’s actual location can be difficult, impacting how tax is calculated.

3. Economic Nexus Confusion

You don’t need to be physically located in a state or country to owe taxes there. If your revenue or number of transactions crosses a threshold, you've established economic nexus.

For example:

Texas requires sellers with $500,000+ in annual sales to collect sales tax.

EU countries have no minimum threshold for VAT — you must register and remit VAT on the first sale.

4. Keeping Up with Changing Laws

Tax rules change fast. New states pass legislation. Rates adjust. Thresholds shift. If you aren’t monitoring these changes, you risk falling out of compliance — even if you're doing your best.

eCommerce Partner

Thrive with the industry's most innovative all-in-one SaaS & Digital Goods solution. From high-performing payment and analytics tools to complete tax management, as well as subscription & billing handling, PayPro Global is ready to scale your SaaS.

Sell your SaaS globally with PayPro Global!

International Video Games Tax Complexity: VAT and GST

Sales tax is collected by a retailer from its customers or users whenever a transaction is made. Subsequently, the retailer is required to remit this money to the relevant tax authorities, according to the laws of that jurisdiction.

As a game developer and the sole proprietor of the video game, you may need to charge SaaS online sales tax in certain jurisdictions where customers have paid for your product or streaming services.

What Are VAT and GST?

- VAT (Value Added Tax) is charged in the EU, UK, and other global regions.

- GST (Goods and Services Tax) is used in countries like Canada, Australia, and India.

Why They’re Complicated

Rates vary by country (e.g., France 20%, Germany 19%, UK 20%).

You must register separately in each country where you sell.

You need to generate tax-compliant invoices in local formats and languages.

Each country has its own filing process and deadlines.

Mistakes Can Be Costly

If you under-collect VAT or file late, you can face fines, back taxes, and even restrictions on doing business in that region.

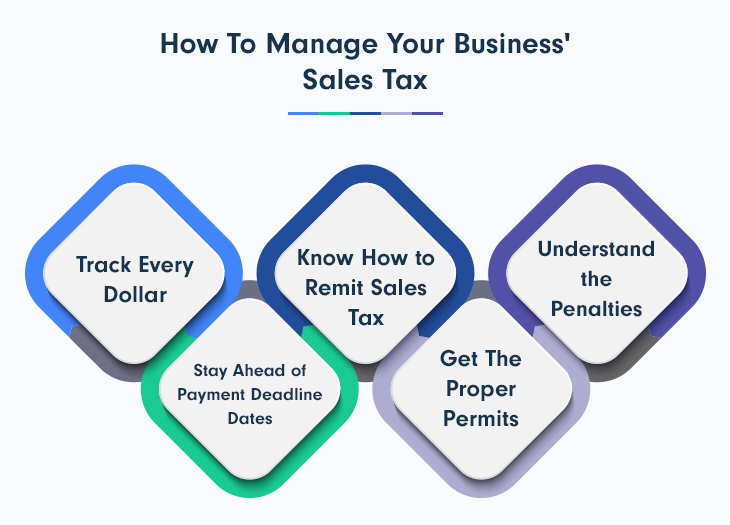

5 Steps To Manage Your Video Games Tax

When it comes to managing your royalty payments and tax-related issues in the day-to-day life of your business, it's essential to stay well informed to be assured you are always in compliance. Books like The Definitive Guide to Taxes for Indie Game Developers provide helpful industry-specific tax information.

Take a look at these five practical tips to keep the process running efficiently and smoothly so companies can stay on top of all tax issues, requirements, and regulations.

1. Track Every Dollar

To manage taxes on video games efficiently and compliantly, you'll need to keep thorough records of your sales and where they originated. Keep these records organized and accessible at all times. Again, don't be afraid of consulting professionals ‒ a good accounting service can make all the difference!

2. Stay Ahead of Payment Deadline Dates

The timing of tax remittance can vary from state to state, so you'll need to keep an online calendar to help you stick to deadlines. Some states require tax to be remitted monthly, while others expect it quarterly or yearly. Don't forget that public holidays and weekends may affect when you need to pay tax.

3. Know How to Remit Sales Tax

Research how each applicable jurisdiction expects the tax to be remitted. How do the jurisdictions accept their sales tax payments, for example?

Thankfully, you can access this information on each state's sales tax website. Or you can check PayPro Global's Sales Tax resource.

4. Get The Proper Permits

Every business needs a sales tax permit to pay taxes. If you understand economic nexus, you can track the states where you have reached nexus and apply for the relevant sales tax permits there.

Again, do not hesitate to use a professional regarding tax issues since errors can be detrimental to your business.

5. Understand the Penalties

Tax non-compliance can come with hefty fines and penalties. And there's nothing like avoiding fines and legal action to keep businesses motivated to raise taxes correctly.

Do your research, and check the many existing resources to understand the consequences of mistakes and how to avoid them. It is not possible to overemphasize this point!

How a Merchant of Record (MoR) Solves Video Game Tax

A Merchant of Record acts as the legal seller of your game — handling sales tax, compliance, invoicing, and payments on your behalf.

Key Benefits of Using an MoR

Tax Compliance: Calculates and collects the correct sales tax, VAT, or GST based on the buyer’s location.

Global Registrations: Handles tax registrations in every required state or country.

Accurate Invoicing: Issues localized, tax-compliant invoices.

Remittance & Filing: Submits all taxes to the correct authorities on your behalf.

Risk Mitigation: Shields you from legal and financial penalties tied to non-compliance.

An MoR makes it possible for small teams to scale globally without building internal tax or legal departments.

Why Choose PayPro Global as Your Merchant of Record?

PayPro Global is more than just a tax automation tool. We serve as your fully accountable Merchant of Record, taking care of every step in the sales, tax, and compliance process — so you can focus on making great games.

What Makes PayPro Global Different?

✅ Full Compliance Across 200+ Regions

We stay ahead of regulatory changes in every U.S. state, EU country, and other key regions. Our system is updated in real-time as tax laws evolve, ensuring ongoing compliance without manual updates.

✅ Automated Sales Tax, VAT & GST Handling

We calculate, collect, file, and remit all applicable taxes — including complex EU VAT and GST obligations — without requiring action from your team.

✅ Localized Tax Invoicing

Generate legally compliant invoices in the correct formats, languages, and currencies — automatically.

✅ One Unified Platform

From checkout and subscription management to tax, fraud protection, and reporting — everything is handled under one dashboard.

✅ Proven Industry Experience

With over a decade of experience in digital commerce, we serve thousands of SaaS and game developers worldwide. We understand the nuances of indie game sales, virtual currencies, and cross-border transactions.

✅ R&D Tax Credit Guidance (U.S. only)

PayPro Global can assist in documenting qualifying expenses to help U.S.-based developers take advantage of Research & Development tax credits, potentially saving thousands annually.

eCommerce Partner

Thrive with the industry's most innovative all-in-one SaaS & Digital Goods solution. From high-performing payment and analytics tools to complete tax management, as well as subscription & billing handling, PayPro Global is ready to scale your SaaS.

Sell your SaaS globally with PayPro Global!

PayPro Global to Simplify Taxation for Video Game Devs

We understand that correctly calculating and applying the sales tax can be a headache, especially when managing everything else that goes into running a gaming business. PayPro Global offers its partners a unique Merchant of Record model, providing businesses of all sizes with the much-need tools and services to scale smoothly into any market, covering everything from payments to tax, global SaaS compliance, subscription management, and working dutifully to be your trusted advisor.

With over a decade of experience and a team of experts highly versed not only in sales tax laws, PayPro Global's cloud-based solution gives companies that sell eBooks online, video games, and SaaS the needed flexibility to secure their global growth without worrying about taxes and all areas of compliance.

So, if you're still feeling overwhelmed or worried about the sales tax issue for your game development business, our Merchant of Record for gaming companies model can help. Get in touch with PayPro Global for expert tax assistance.

SaaS subscription service allows you to pay an ongoing annual or monthly fee, whereas on-premise solutions come at one initial cost.

FAQs

Do I need to charge sales tax for my video game?

Yes, in most regions you must charge sales tax, VAT, or GST on digital game sales. Rules vary significantly by country and US state, creating a complex global compliance challenge for developers selling their games online.

What is economic nexus and how does it affect game developers?

Economic nexus is a rule that requires you to collect sales tax in a state or country once your sales there pass a certain threshold, even if you have no physical office there. This means selling online can make you liable for taxes in dozens of jurisdictions.

My game is on Steam. Do I still need to worry about sales tax?

Steam handles taxes for purchases made on its platform. However, if you sell game keys, DLC, or other digital goods from your own website, you are fully responsible for managing all sales tax compliance for those direct sales.

Ioana Grigorescu

Ioana Grigorescu is PayPro Global's Content Manager, focused on creating strategic writing pieces for SaaS, B2B, and technology companies. With a background that combines Languages and Translation Studies with Political Sciences, she's skilled in analyzing, creating, and communicating impactful content. She excels at developing content strategies, producing diverse marketing materials, and ensuring content effectiveness. Beyond her work, she enjoys exploring design with Figma.

-

1.Explore PayPro Global's Solutions: See how our platform can help you streamline your payment processing and boost revenue.

-

2.Get a Free Consultation: Discuss your specific needs with our experts and discover how we can tailor a solution for you.

-

3.Download our Free Resources: Access valuable guides, checklists, and templates to optimize your online sales.

-

4.Become a Partner: Expand your business by offering PayPro Global's solutions to your clients.

- Due to differing international tax laws and economic nexus regulations, game makers who sell digital games online must adhere to sales tax regulations.

- By managing sales tax, VAT, GST, invoicing, and international registrations, a Merchant of Record (MoR) such as PayPro Global streamlines tax compliance.

- By collaborating with a MoR to reduce risks and guarantee compliance in more than 200 regions, game companies can concentrate on game development and expansion.

Get the latest news